Beyond the Noise: How to Ignore 'Hot Stock' Hype and Focus on Business Fundamentals

The FOMO Trap: How Quality Companies Create Real Wealth

I was scrolling through my X feed the other day when I saw it... again.

"NVIDIA up another 5% today!"

"This AI stock could be the next NVIDIA!"

"Don't miss the next 10x opportunity in this overlooked AI play!"

Sound familiar? We've all been there. The siren song of hot stocks is powerful, especially when you're watching others seemingly get rich overnight. And let me tell you, that fear of missing out? It's real. I've felt it too.

But here's the thing...

Most investors are playing the wrong game entirely. They're chasing price movements instead of focusing on what actually creates wealth over time: owning exceptional businesses that compound value year after year.

I've learned this lesson the hard way. Early in my investing journey, I jumped from one hot stock to another, always chasing the next big thing. My results? Mediocre at best, frustrating at worst.

The turning point came when I realized that investing isn't about following the crowd. It's about understanding businesses and having the discipline to focus on what matters while everyone else is distracted by noise.

Let's talk about how you can do exactly that.

The Psychology Behind Market Noise

There's something you need to understand first: your brain isn't wired for rational investing.

When you see everyone piling into the latest hot stock, your brain triggers ancient survival mechanisms. We're social creatures who evolved to follow the herd for safety. When we see others running in one direction, our instinct is to run with them.

This herding behavior gets supercharged by social media platforms designed to maximize engagement. Financial influencers know exactly which buttons to push to trigger your FOMO (fear of missing out), often with limited accountability for their recommendations.

Recent research in behavioral finance has shown that investors are particularly susceptible to narrative-driven decisions. We connect with stories, not spreadsheets. That's why you'll remember a compelling story about a company's future potential more easily than its price-to-free-cash-flow ratio.

And there's the dopamine factor. Let's be honest – checking a volatile stock that's up 10% delivers a rush similar to gambling. That's no coincidence. The same neural pathways get activated, making hot stock trading genuinely addictive.

The True Cost of Following Hype

Beyond just poor returns, there's a hidden cost to chasing hot stocks that often goes unmentioned.

First, opportunity cost. Every dollar tied up in a speculative play is a dollar not invested in quality businesses building real value. And this compounds over time – spectacularly.

Just look at the 2024 AI stock bubble. Many companies with tenuous connections to artificial intelligence saw their stocks soar simply by mentioning "AI" in press releases. Sound familiar? It should – it's eerily reminiscent of companies adding ".com" to their names during the dot-com bubble.

Take SoundHound AI, which skyrocketed 836% in 2024 after investors discovered Nvidia had a stake in it. But as details emerged, it turned out Nvidia's investment was quite small and made years earlier. By early 2025, Nvidia had exited its position entirely.

Meanwhile, Microsoft – a company genuinely transforming its business with AI – delivered steady gains backed by growing free cash flow, not just hype.

The psychological cost is perhaps even greater. The stress of watching volatile stocks, constantly checking prices, and second-guessing decisions takes a real toll. I've known investors who check their portfolios dozens of times daily during market hours. That's not investing – that's an anxiety disorder.

What Really Matters: Business Fundamentals

So what should you be focusing on instead of stock price movements? Let me break down the factors that actually drive long-term wealth creation:

1. Operating Leverage

This is one of my favorite concepts because it's so powerful yet often overlooked. Operating leverage simply means a company can grow revenue without proportionally increasing costs.

Think about software companies like Microsoft. Once they build their product, each additional customer costs them very little to service, but brings in the same revenue. That's why Microsoft's operating margin expanded from 25% in 2010 to 43% in 2024.

When you find businesses with high operating leverage, you've found a compounding machine where growth becomes increasingly profitable over time.

2. Competitive Moats

Warren Buffett popularized this concept, and it remains essential. A moat is what protects a business from competition trying to steal its profits.

Microsoft has multiple moats:

Switching costs (try moving an enterprise from Office 365)

Network effects (Teams becomes more valuable as more people use it)

Scale advantages (they can spread R&D costs across billions in revenue)

When analyzing any business, ask yourself: "What prevents a competitor from coming in and taking their customers or forcing them to lower prices?" If you can't answer that convincingly, you might be looking at a poor long-term investment.

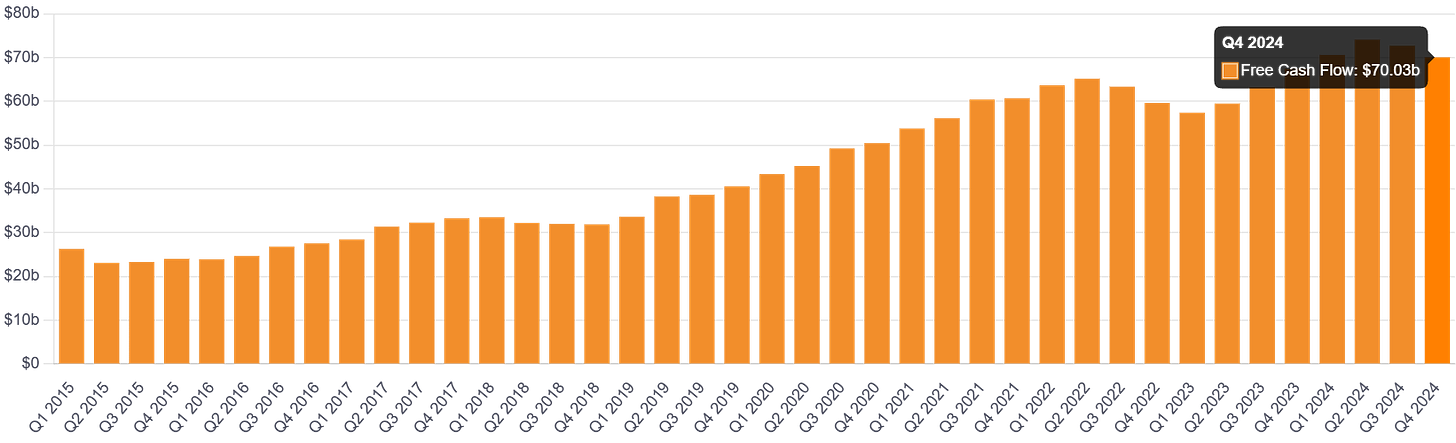

3. Free Cash Flow Generation

Revenue is vanity, profit is sanity, but cash is reality.

Free cash flow – what's left after a company pays all expenses and necessary investments – is what actually matters. This is the money that can be returned to shareholders through dividends and buybacks or reinvested for future growth.

Microsoft generated over $72 billion in free cash flow in 2024, up 23% year-over-year. That's real money that can create real shareholder value, not just a promising story about future potential.

4. Management Quality and Capital Allocation

A great business can be destroyed by poor management, while good management can transform an average business.

Satya Nadella's leadership at Microsoft demonstrates this perfectly. When he took over in 2014, Microsoft was stagnating, missing mobile and cloud opportunities. His shift to cloud-first and willingness to work with competitors (releasing Office for iOS, for instance) unleashed tremendous value.

Quality management allocates capital intelligently – whether through organic investments, acquisitions, or returning capital to shareholders. They think long-term while delivering short-term results.

Practical Techniques to Cut Through Noise

Now for the actionable part – how do you actually stay focused on fundamentals in a world designed to distract you?

1. Information Diet Management

Start by auditing your information sources. Are they focused on business performance or stock prices? Do they analyze competitive advantages or just repeat consensus opinions?

I've dramatically improved my investing by:

Unfollowing stock price commentators on social media

Reading quarterly reports directly instead of headlines

Following business analysts rather than market commentators

Limiting financial news consumption to once weekly

2. Create Your Investment Checklist

Develop a systematic approach to evaluating businesses. My personal checklist includes:

Operating margin trend (improving or declining?)

Free cash flow conversion (>90% of net income?)

Return on invested capital (>15%?)

Revenue growth rate (>10%?)

Identifiable competitive advantages

This forces me to focus on what actually matters when everyone else is distracted by narratives and price movements.

3. Simple Metrics to Focus On

If spreadsheets make your eyes glaze over, start with just three numbers:

Free cash flow growth (is it consistent year over year?)

Operating margin (is it stable or expanding?)

Return on invested capital (is it well above the cost of capital?)

These three metrics tell you more about long-term wealth creation potential than any stock chart.

4. Portfolio Review Discipline

One of the best changes I've made is establishing a fixed schedule for portfolio reviews – quarterly for most positions, with news alerts only for truly material developments.

This prevents the emotional rollercoaster of daily price checking while ensuring I stay informed about actual business developments.

Building Wealth Through Business Ownership

Here's the mindset shift that changed everything for me: I stopped thinking about buying stocks and started thinking about owning businesses.

When you own shares of Microsoft, you're not betting on a stock ticker – you're buying a partial stake in one of the world's most successful enterprises. You're partnering with management to build long-term value.

This ownership perspective naturally pushes you toward quality companies with sustainable advantages rather than speculative bets. It makes you think in terms of years and decades rather than days and weeks.

And that's where the real wealth is built – in the patient compounding of business value over time. While others are frantically trading the latest hot stock, you'll be quietly building wealth through ownership of exceptional enterprises.

The greatest investors understand this. As Warren Buffett famously said, "The stock market is a device for transferring money from the impatient to the patient."

So next time you feel that FOMO creeping in as some hot stock dominates the headlines, remember: the path to investment success isn't found in what's hot today. It's built by focusing on business fundamentals while everyone else is distracted by noise.

That's how you compound wealth over decades. That's how you achieve financial freedom. And best of all, that's how you maintain your sanity in a market that seems increasingly disconnected from reality.

What business fundamentals are you focusing on in your portfolio? How do you block out market noise?