Garmin Premium Page

Garmin: Why It Earns a Spot in Our Portfolio

Last edited 3/1/2025

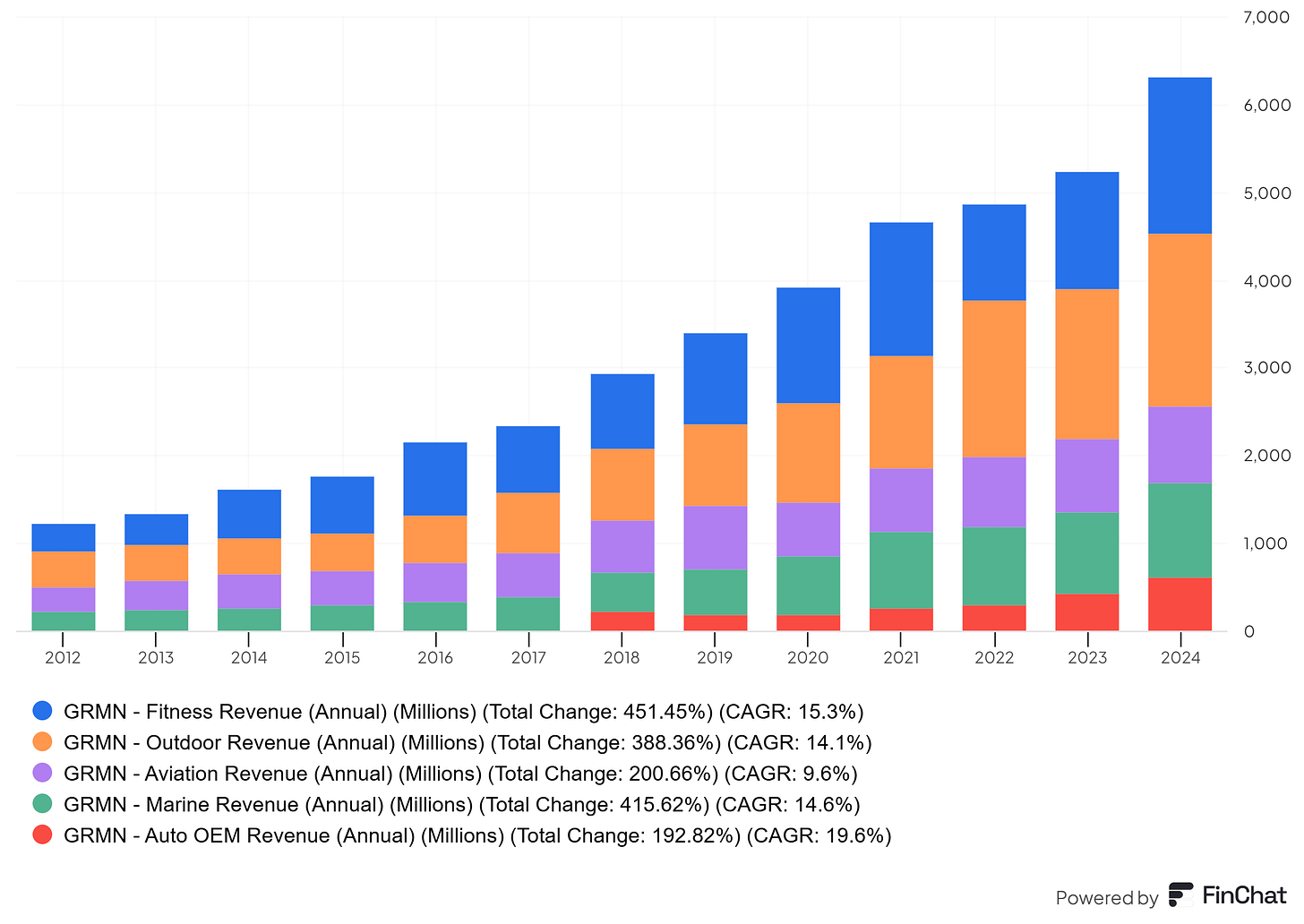

First off, Garmin checks multiple boxes from our investment philosophy. It's a market leader with dominant positions across five segments: Fitness, Outdoor, Aviation, Marine, and Auto.

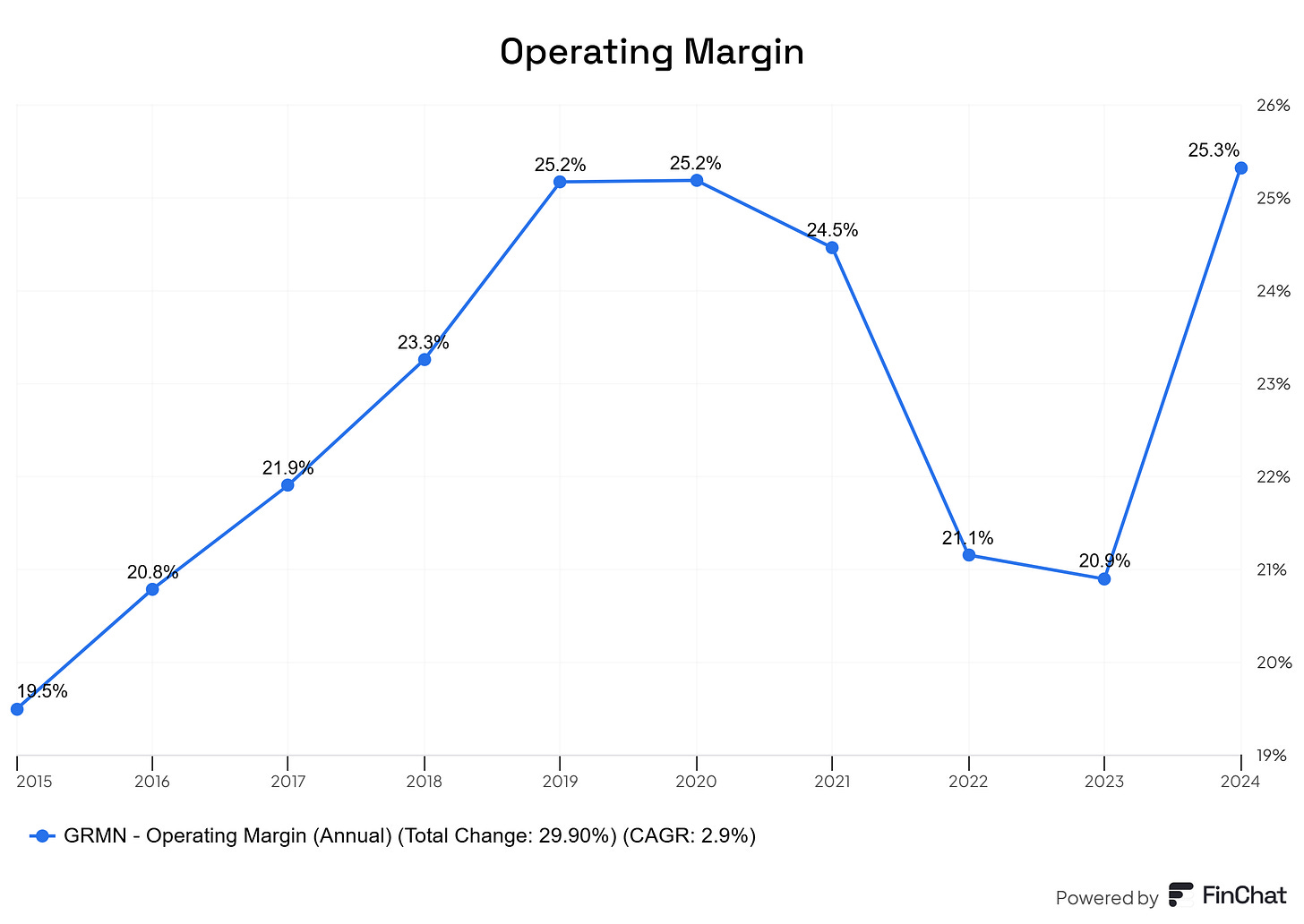

But what really stands out is its operating leverage – their operating margin expanded to 21.6% in Q1 2024, up from 17.2% the previous year. This is exactly the kind of operating efficiency we want to see! When a company can grow revenue while expanding margins, that's a powerful combination that leads to accelerated earnings growth.

Another reason we love Garmin? Pricing power. The company sells premium products at premium prices (like the $699+ Fenix watches) and customers keep coming back. This pricing strength shows up in their gross margins of 58.1% – substantially higher than competitors like Fitbit.

When a company can raise prices without losing customers, that's a strong signal they've built something special that people truly value.

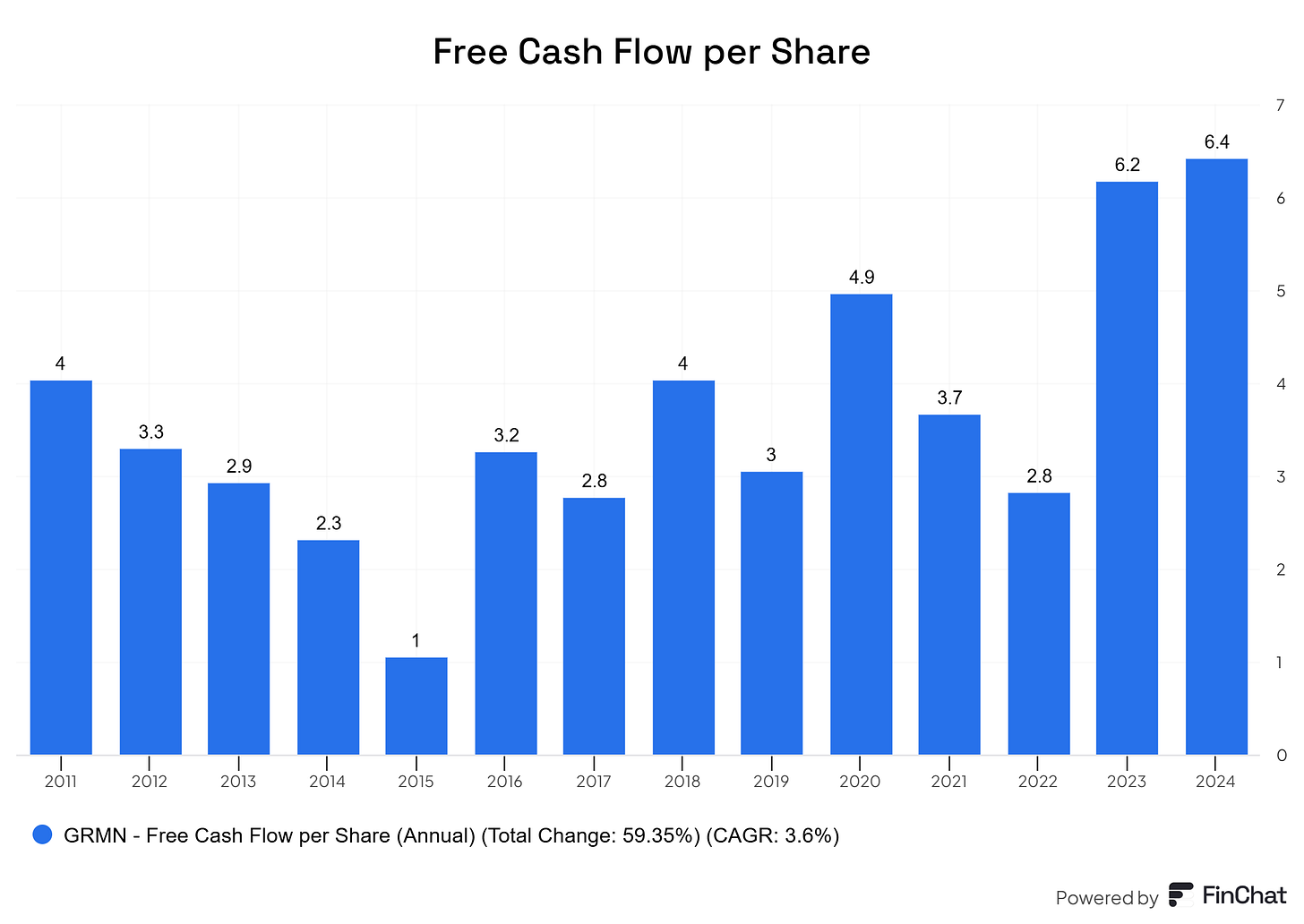

What about capital allocation? Garmin ticks this box too. Management returns cash to shareholders through a growing dividend (recently proposing a 20% increase to $3.60/share) while maintaining a rock-solid balance sheet with $2.2 billion in cash and minimal debt.

This financial strength gives them flexibility to weather economic storms and invest in future growth opportunities without diluting shareholders.

When we look at the long-term picture, Garmin isn't just surviving – it's thriving in an increasingly competitive landscape by focusing on specialized markets where their technical expertise creates genuine barriers to entry. This is exactly the kind of durable competitive advantage that can drive long-term compounding for years to come.

The Garmin Story: From GPS Pioneer to Diversified Tech Powerhouse

Imagine buying a stock that started as a niche GPS provider and transformed into a diversified technology leader dominating multiple markets. That's exactly what we have with Garmin. Founded in 1990 by Gary Burrell and Dr. Min Kao (whose names combine to form "Garmin"), the company began with a focus on aviation and marine navigation systems. What's fascinating about Garmin's journey is how they've maintained their technical edge despite fierce competition from tech giants. While Apple and Samsung entered the wearables market with massive marketing budgets, Garmin carved out defensible niches by focusing on specialized needs that mass-market products couldn't address.

The secret to Garmin's success isn't complicated, but it's incredibly difficult to replicate. Their vertical integration – designing and manufacturing products in-house rather than outsourcing – gives them control over quality and innovation that competitors simply don't have. This advantage shows up clearly in battery life (Garmin's Fenix watches last 84 hours in GPS mode compared to Apple Watch's 18 hours) and specialized features like the HRM-Fit heart rate monitor designed specifically for women's sports bras with 99.4% accuracy. These aren't just incremental improvements; they're solving real problems for athletes and outdoor enthusiasts who won't compromise on performance. And customers are rewarding this focus – Garmin boasts a 73% loyalty rate, highest among their target demographics of serious outdoor enthusiasts and athletes.

Looking ahead, Garmin is positioning itself at the intersection of powerful trends:

Post-pandemic outdoor recreation surge driving demand for rugged, reliable navigation devices

Growing health consciousness across all age demographics, from Gen Z to Boomers

Wearable health monitoring evolution from simple step counters to advanced biometric tools

Their acquisition of Firstbeat Analytics and partnerships with medical institutions like Johns Hopkins are transforming their devices from simple fitness trackers into potential clinical tools for conditions like hypertension and sleep apnea. This isn't just about selling more watches – it's about creating an ecosystem of health and navigation services that keeps customers coming back.

With $612 million planned for Asia-Pacific expansion and continued innovation in autonomous navigation systems, Garmin is demonstrating exactly the kind of long-term thinking we value in our portfolio companies.

Garmin: Past Earnings Tracking

Q1 2025 (February 19, 2025)

Revenue: $1.82 Billion, a substantial beat of 7.29% compared to estimates.

EPS: $2.41, an impressive beat of 26.84% compared to estimates.

Result: Beat.

Q4 2024 (October 30, 2024)

Revenue: Beat expectations by 9.84%.

EPS: Beat expectations by 38.19%.

Result: Beat.

Q3 2024 (July 31, 2024)

Revenue: Beat expectations by 5.84%.

EPS: Beat expectations by 9.72%.

Result: Beat.

Q2 2024 (May 1, 2024)

Revenue: Beat expectations by 10.48%.

EPS: Beat expectations by 40.59%.

Result: Beat.

Q1 2024 (February 21, 2024)

Revenue: Beat expectations by 4.79%.

EPS: Beat expectations by 22.86%.

Result: Beat.

Garmin just delivered a knockout quarter with revenue up 23% year-over-year to $1.82 billion. This wasn't just a one-segment wonder – management reported growth across all five business segments. For the full year, they reached $6.3 billion in revenue, a substantial 20% jump from the previous year.

Management demonstrated exceptional execution, especially in the fitness segment, which surged by an impressive 32% to $1.77 billion. When a segment grows at this rate, it's worth paying attention to what's driving that momentum.

Expanding Margins Tell the Quality Story

What really stands out here isn't just the top-line growth. The company achieved a gross margin of nearly 59% – a testament to Garmin's pricing power and operational efficiency.

Operating income increased by 52% to $516 million in Q4, with pro forma EPS growing 40% year-over-year to $2.41. These aren't small improvements – they're significant leaps that show management's ability to translate revenue growth into even stronger profit growth.

Confidence in Future Growth

Management isn't just celebrating past results – they're positioning for continued expansion. CEO Cliff Pemble specifically highlighted their "robust product portfolio" as a key driver of strong demand.

The proposed 20% dividend increase speaks volumes about management's confidence in Garmin's financial health and future cash flow generation. They're not just talking about growth – they're putting their money where their mouth is by returning more capital to shareholders.

What This Means For Us

Strong performance across all segments tells us that Garmin's diversification strategy is working effectively. The company isn't reliant on just one product category to drive results, which reduces risk and creates multiple avenues for growth.

When management consistently delivers results that exceed expectations while maintaining healthy margins, it validates our investment thesis that Garmin is building a sustainable competitive advantage in its markets.

What to Watch in Garmin's Future Earnings

Revenue Growth Across All Segments

Garmin's recent 23% revenue jump was impressive, but can they maintain this momentum? We'll be watching closely to see if they hit their projected 8% growth target for 2025. What I'm particularly interested in is which segments drive this growth – will fitness continue its stellar 32% rise, or will we see other segments pick up the pace?

Margin Expansion is Key

That 59% gross margin is what separates Garmin from competitors. We need to track if they can maintain or even expand this margin as they scale. Why does this matter? Because it shows they're not discounting to drive sales, but instead offering products customers are willing to pay premium prices for.

New Product Reception

Garmin's planning several product launches in 2025. The market's reception to these will tell us a lot about their innovation pipeline. I'll be watching not just for initial sales figures, but for reviews and customer feedback. Does Garmin still have its finger on the pulse of what serious athletes and outdoor enthusiasts want?

Dividend Growth as a Signal

The proposed 20% dividend increase isn't just good for our portfolio – it's a powerful signal about management's confidence in future cash flow. We should compare this dividend growth rate with actual earnings growth to ensure it's sustainable long-term.

International Expansion Progress

With $612 million planned for Asia-Pacific expansion, we need to monitor quarterly geographic breakdowns. Are they gaining traction in these new markets? The success of this international push could unlock significant new growth avenues beyond their established markets.

When I'll Buy More or Sell Garmin

I'll consider adding to our Garmin position when it trades significantly below its intrinsic value compared to our other holdings. What does that look like? Specifically, if we see Garmin trading at a forward P/E below 25 while maintaining its current growth trajectory and margin profile, that's my buy signal. At that valuation, we'd essentially be getting Garmin's future growth at a discount, which is exactly the opportunity I look for.

On the flip side, I'd consider selling Garmin if the fundamentals start to deteriorate. What would this look like? I'm watching for three key warning signs: First, if gross margins drop below 55% for two consecutive quarters, suggesting pricing power is eroding.

Second, if free cash flow per share growth stalls or turns negative, indicating the business isn't generating the capital needed for reinvestment and shareholder returns.

Third, if we see a significant loss of market share in their core segments, especially fitness and outdoor, where competitive moats are essential.

Remember - I'm not looking to sell based on short-term stock price movements or temporary setbacks. The decision would be based on fundamental changes to the business that undermine our investment thesis. This is how patient, disciplined investors build wealth... by focusing on business quality and valuation, not market noise.