Why I Sold All My Costco Stock (And When I'll Buy Again)

The critical difference between loving a business and finding a great investment opportunity at the right price

I made a difficult decision last week.

I sold all my Costco shares.

Now before you think I've lost my mind, let me explain why this move perfectly aligns with my investment philosophy—and why it might make you reconsider how you think about your own holdings.

This isn't a story about Costco being a bad business. Far from it. It's about the critical difference between recognizing a great company and finding a great investment opportunity.

Let me walk you through my thinking...

Costco: The Business Everyone Loves (Including Me)

I've always admired Costco's business model. It's elegantly simple yet incredibly effective.

They charge members an annual fee ($60 for basic, $120 for executive) for the privilege of shopping in their warehouses. This creates a recurring revenue stream that contributed over $1.19 billion in the latest quarter alone—pure profit that flows straight to the bottom line[5].

Their renewal rates are consistently above 90%[4], showing just how sticky their membership model truly is. When customers are willing to pay just to access your store, you know you've built something special.

What's fascinating about Costco is how they've turned retail logic upside down. While most retailers mark up products by 25-50%, Costco caps markups at around 14%[4]. They deliberately sacrifice per-item profits to drive volume and member loyalty.

Their recent performance remains strong:

Q2 fiscal 2025 net sales up 9.1% to $62.53 billion[1]

Comparable sales grew 6.8% (excluding gas and forex)[1]

E-commerce sales increased by 20.9%[5]

These aren't numbers of a business in trouble. Costco continues executing its model beautifully.

Yet despite all these positives, I still sold.

The Valuation Chasm That Can't Be Ignored

Here's the problem: Costco's stock price has completely disconnected from business reality.

When I sold Costco, it was trading above $1,000 per share with a P/E ratio over 60. Let that sink in. For every dollar of earnings, investors were paying over $60. That's not just expensive—it's in nosebleed territory.

Interestingly, since I sold, the stock has dropped to below $900 with the P/E ratio coming down to around 52. The market seems to be slowly recognizing the valuation concerns I had.

Even more concerning, the company's EV/FCF ratio sits at 92.08[2]. That means you're paying $92 for each dollar of free cash flow the business generates.

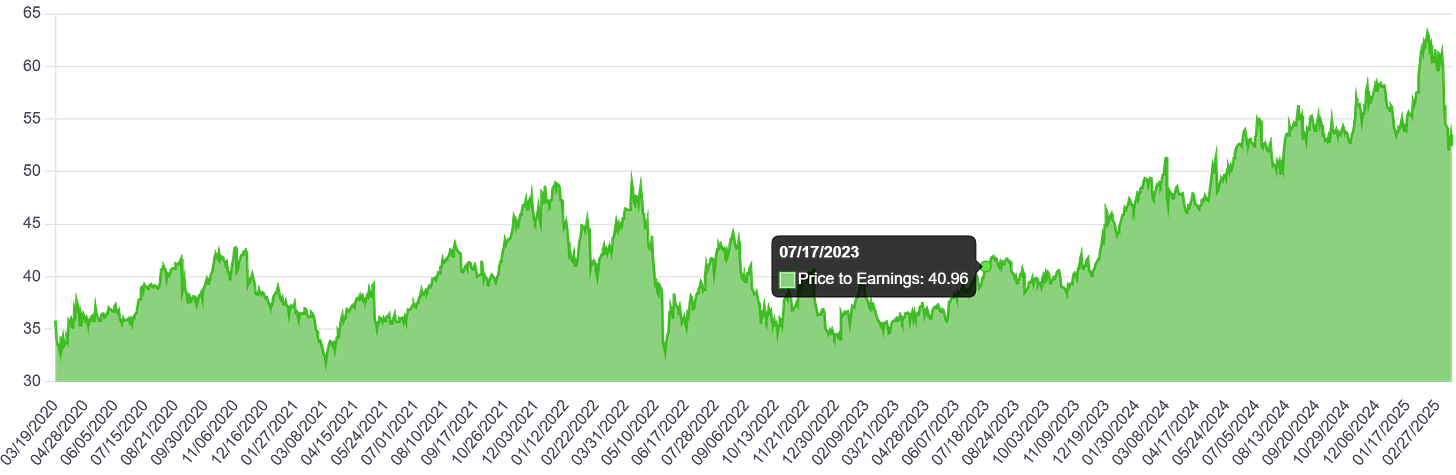

The chart below shows Costco’s P/E Ratio over the last 5 years.

For context, over the past 13 years:

Costco's median EV/FCF ratio was 35.76[2]

The current ratio is 2.5x higher than this historical average[2]

I'm not against paying premium prices for premium businesses. But there comes a point where the numbers simply don't add up—where even the best business can't grow fast enough to justify its valuation.

That's exactly where Costco sits today.

My DCF Analysis: The Math Doesn't Lie

I'm not one to throw around fancy financial terms to sound smart. But sometimes, you need to roll up your sleeves and do the math.

With the recent price drop, I've updated my analysis. Assuming a more optimistic 10% EPS growth rate and an ending P/E of 50 after five years, Costco at current prices would return about 9% annually. That puts it in "hold territory" for investors who already own it, as it should roughly match what you could expect from an S&P 500 index fund like VOO.

For me to achieve my target 15% annual return, I calculated I'd need to buy Costco at $685 per share based on current metrics. That's still about 25% below today's price.

Could I be wrong? Absolutely. Maybe Costco will grow faster than expected. Maybe they'll find new ways to monetize their loyal customer base. Maybe the market will continue to reward them with ever-higher multiples.

But investing isn't about hoping for the best case. It's about making decisions based on probabilities and protecting yourself against downside risk.

Why 15% Is My Minimum Threshold

You might be wondering: "Why 15%? Isn't that setting the bar too high?"

Here's my thinking: If I'm going to take on single-stock risk rather than just buying an index fund, I need to be compensated for that extra risk.

The S&P 500 (through an ETF like VOO) has historically returned around 10% annually and I expect it to deliver about 9% over the next five years. So my individual stock picks need to substantially outperform that benchmark to justify:

The additional volatility

The company-specific risks

The time I spend researching and monitoring positions

If I can't reasonably expect at least 15% annual returns over a 5-year period, I'd rather just put that money into VOO and spend my time and mental energy elsewhere.

Remember: Every dollar you keep in an overvalued stock is a dollar you can't invest in a genuinely undervalued opportunity. This opportunity cost is real, and it compounds over time.

The Emotional Challenge of Selling Winners

I won't lie—selling Costco wasn't easy.

There's comfort in owning businesses you understand and admire. And there's always that nagging fear: "What if the stock keeps going up after I sell?"

But I've learned that successful investing requires separating emotion from analysis. It means being willing to:

Buy when others are fearful (even when it feels uncomfortable)

Sell when others are greedy (even when it feels like you might miss out)

Warren Buffett said it best: "The stock market is a device for transferring money from the impatient to the patient."

I'm playing the long game here. I'd rather miss out on some potential upside than risk significant capital on a valuation that demands near-perfect execution.

And I'm not saying goodbye to Costco forever. At today's price below $900, it's getting more reasonable, but I'm still waiting for a better entry point. If the stock falls to around $685 per share—or if the business grows into its current valuation—I'd be happy to become a shareholder again.

The Takeaway: Great Business ≠ Great Investment

The most important investing lesson I've learned is this: The quality of a business and the quality of an investment opportunity are not the same thing.

Costco is a fantastic business that I'd be proud to own at the right price. But at today's valuation, the math simply doesn't work.

This discipline—being willing to walk away from great companies when their prices don't make sense—has served me well over time. It's how I avoid the expensive mistakes that can permanently impair capital.

So take a hard look at your own portfolio. Are you holding onto stocks simply because you love the businesses? Or because the valuations actually support your long-term return goals?

Sometimes the hardest investment decisions are the ones that ultimately protect your wealth the most.

What do you think? Have you ever sold a company you loved because the price got too high? Or do you have a different approach to valuation? I'd love to hear your thoughts.

Until next time, Michael

Sources:

Costco Investor Relations - Q2 FY2025 Results

GuruFocus - Costco Valuation Metrics

MacroTrends - Costco Free Cash Flow History

LinkedIn Analysis - Costco Business Model

Investing.com - Costco Q2 FY2025 Earnings Call Transcript

Nice read. Buffett said Costco is his biggest regret.

Great update, very interesting move and great to see your thinking. Makes sense. They do look pricey now. I also liked that you shared your sources at the end. Nice touch. Might start doing the same. Thanks for this one.