I just made a move in my portfolio that might surprise you.

I sold Apple. Yep, one of the biggest companies in the world, the $3.7 trillion tech giant that everyone seems to love.

And I replaced it with S&P Global.

This wasn't a decision I made lightly. Apple made up about 5% of my portfolio, and I've held it for a while.

But when I looked at the numbers and thought about future growth potential, it just made sense to make the switch.

Let me walk you through my thinking...

The Problem with Apple at $3 Trillion

Apple is valued at over $3 trillion, making it the most valuable company in the world.

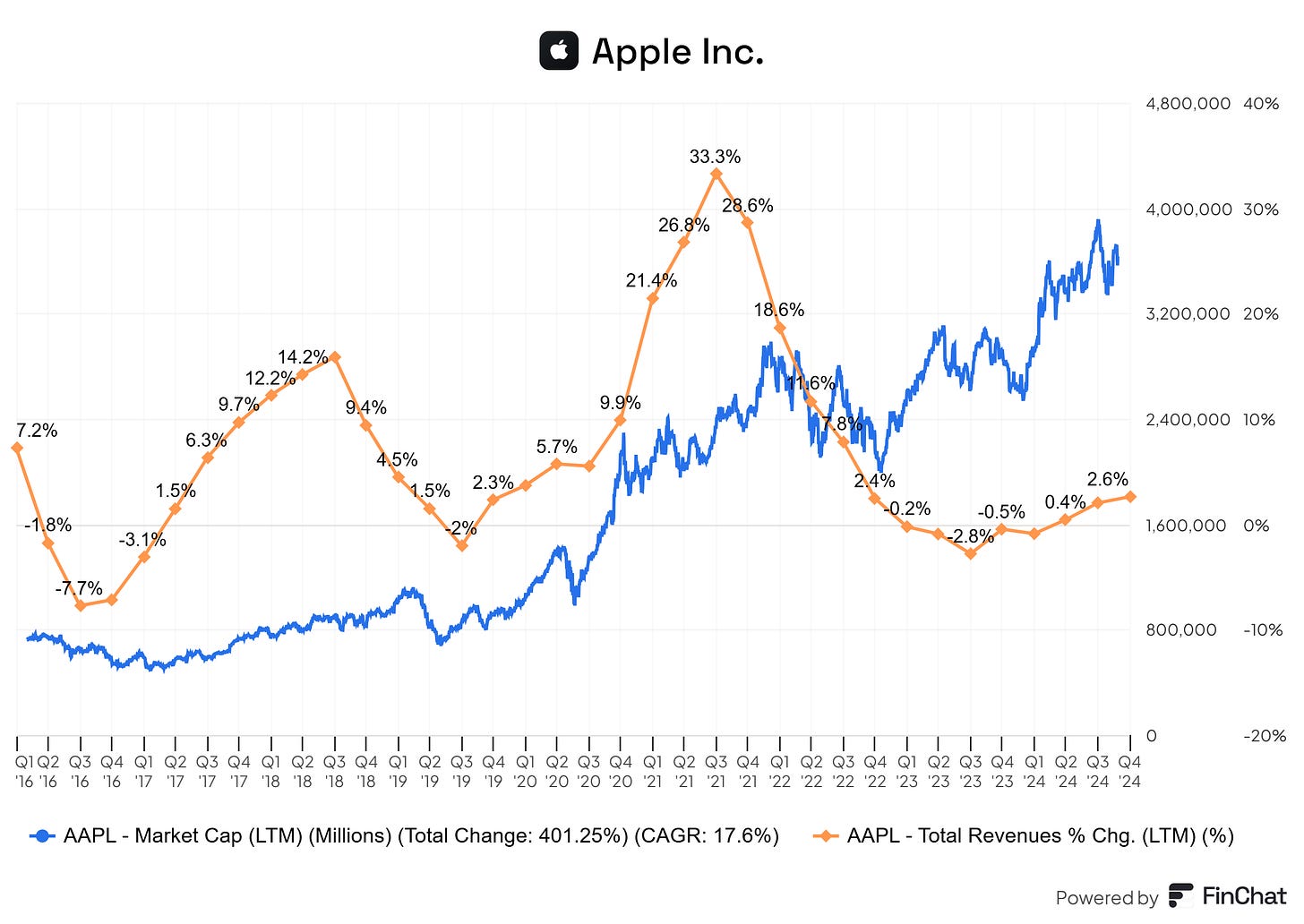

But here's the disconnect that started to concern me: their revenue is only growing at around 4% year-over-year.

Just look at that chart.

The orange line showing their market cap has shot up dramatically, while the blue line showing their year-over-year revenue growth has been trending down.

In fact, revenue actually declined in 2023.

When I dive deeper into Apple's business segments, the picture doesn't get much better:

Hardware sales (which make up most of their revenue) have only been growing at about 3% annually

In the last two years, hardware sales have actually declined in revenue

Their services segment is growing at around 11%, but it's not enough to move the needle significantly

Another big concern? Increasing competition:

Samsung has regained the global lead in smartphone market share

In China, Apple's market share has fallen from 18% to 12%

Chinese companies like Huawei have government backing in a market where the government has enormous influence

In India, Apple only has about 5% market share, far behind competitors at 18-21%

Then there's the issue of market saturation.

In developed markets like the US and Europe, almost everyone who wants an iPhone and can afford one already has one.

People are holding onto their phones longer too - 42 months now instead of 36 months a few years ago.

New product categories haven't delivered iPhone-level success:

Apple Watch was successful but nowhere near the iPhone's scale

HomePod struggled

AirPods face increasing competition

Vision Pro is technically impressive but too expensive for mass adoption

As for Apple Intelligence (their AI play)?

Only about 60% of active iPhones can even support it, delaying ecosystem adoption.

And testing shows it trails competitors like ChatGPT and Google Gemini.

What I Look For as a Long-Term Investor

When I invest, I'm looking for businesses that can compound wealth over time.

With decades ahead of me, I can take on more risk than older investors and don't need to focus on capital preservation or high dividend yields.

Even with my higher risk tolerance, I have specific criteria:

Strong moats

Operating leverage

Pricing power

Growing free cash flow year after year

I'm willing to pay up for quality companies because I have time to let them compound.

When you're young, your biggest asset is time.

Why S&P Global Fits My Investment Philosophy

If you're not familiar with S&P Global, they're basically a financial intelligence powerhouse. They:

Own the S&P ratings business that rates debt for companies and governments

Provide data analytics and indices crucial to financial markets

What really attracted me is their moat.

They operate in a duopoly with Moody's in the credit ratings market.

When companies need to issue debt, they need these ratings. The trust and reputation these agencies have built over decades creates a massive barrier to entry.

While Apple constantly innovates and fights off competitors in the hardware space, S&P Global has a much more durable competitive advantage.

Their brand reputation in credit ratings has been practically impossible to replicate.

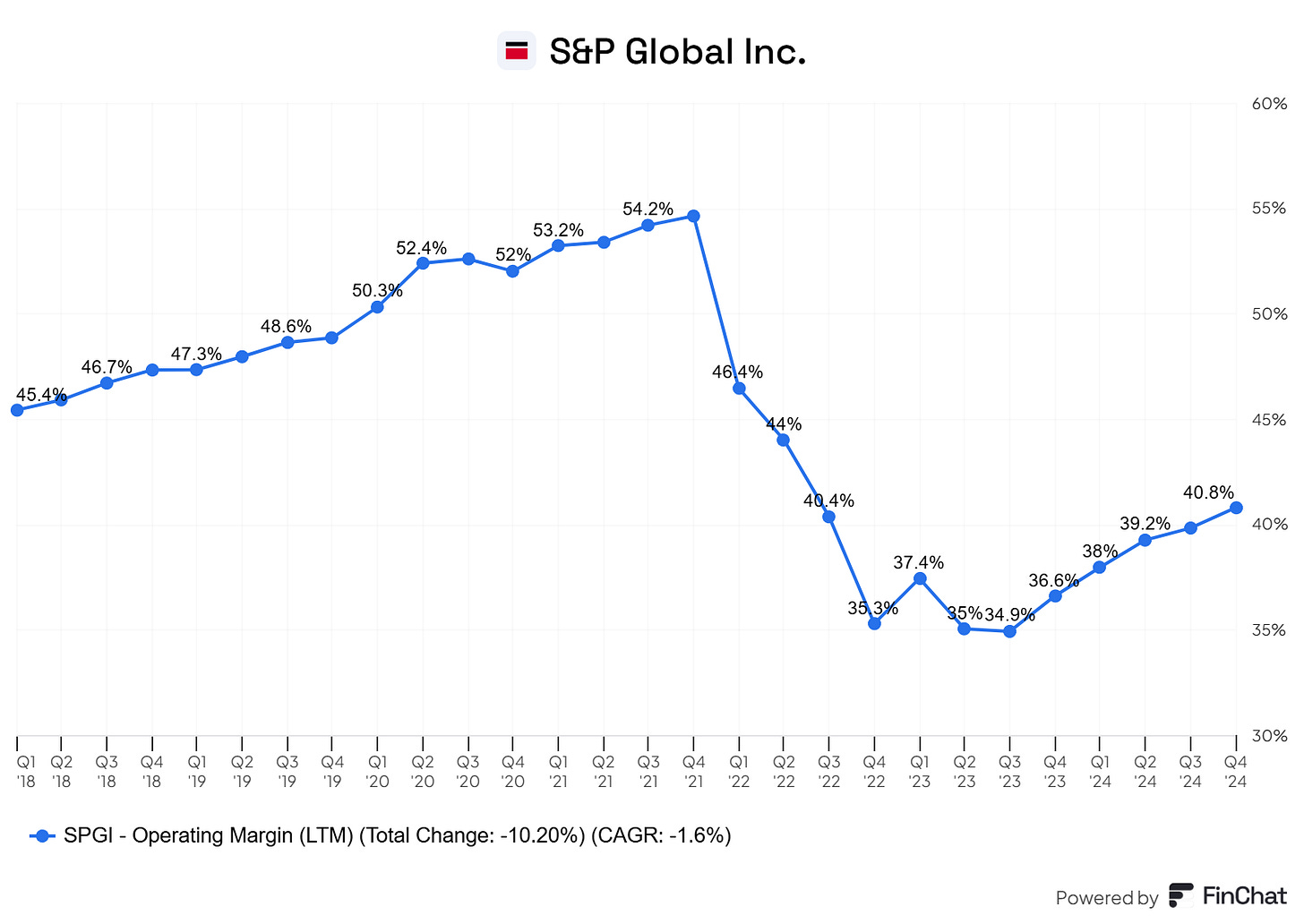

Looking at the fundamentals, S&P Global has been growing revenue at 5-7% on average in recent years, with margins around 47%.

They're expanding with AI and data analytics, which should fuel growth for years to come.

As you can see, their operating margin has been trending upward since 2021, with a temporary dip due to a strategic acquisition that strengthened their data analytics business.

About 78% of S&P Global's revenue comes from subscriptions and asset-linked fees.

This creates predictable, recurring revenue streams with high customer retention rates above 90% - exactly the kind of stability I want in a long-term holding.

Their ESG analytics revenue hit $600 million in 2024 and grew over 40% year-over-year. That's the kind of growth I want to see!

It's being driven by structural changes in how businesses operate and report environmental impact.

The global corporate debt rated by S&P Global reached nearly $24 trillion in July 2024, up 3.3%, with new debt issuance specifically growing 4%.

This growth, fueled by interest rates and refinancing needs, directly benefits their ratings division.

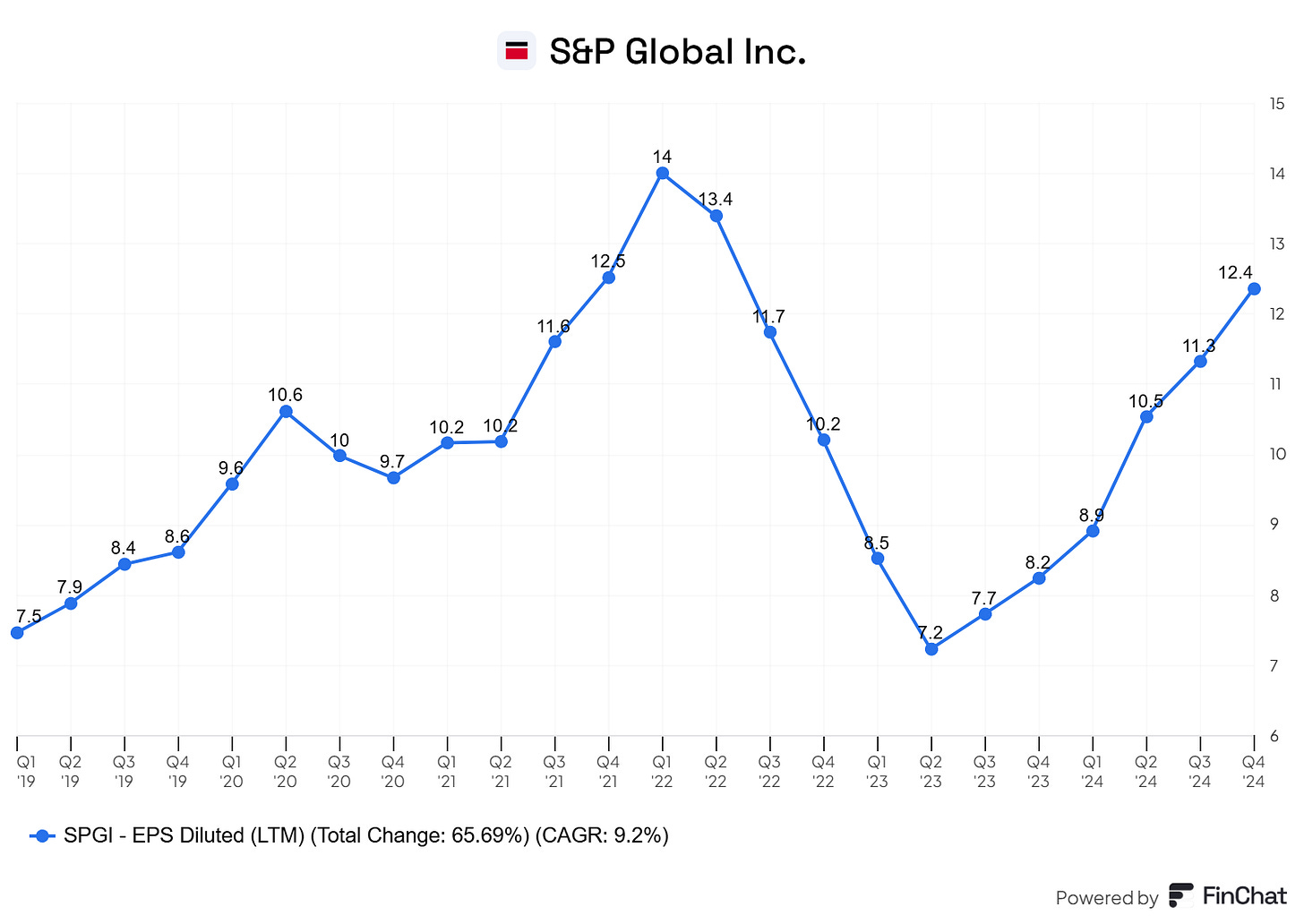

Their earnings per share have shown impressive growth, with a 50% increase last year.

I look for companies that can grow EPS by about 15% year-over-year for long-term outperformance, and I'm confident S&P Global can deliver.

They're also implementing AI in meaningful ways:

Launched automated data ingestion within their ESG platform, reducing manual processing time by 70%

Acquired Proto NLP in December 2024 to enhance their AI capabilities

While Apple talks about AI, S&P Global is actually implementing it in more impactful ways

Valuation Comparison

Let's talk numbers.

S&P Global trades at about 31.5 times forward earnings.

That's not cheap, but when you consider their 8.3% EPS growth rate and 20% return on equity, I think the premium is justified.

Compare that to Apple at nearly 40 times forward earnings with slower growth, and S&P Global starts to look like the better value.

S&P Global actually trades at about a 12% discount to DCF fair value according to some analysts.

The current price is around $525, but fair value estimates range up to $580, suggesting more room for growth.

Their free cash flow hit $5.2 billion in 2024, supporting both dividends and a significant buyback program.

They have $4.3 billion remaining in their buyback authorization - enough to reduce shares outstanding by about 3% annually.

That's the kind of capital allocation I love to see.

If you like dividends, S&P Global has raised theirs for 53 straight years, with average increases of about 10% over the last 5 years.

S&P Global's new CEO (who took over in Q4 2024) has accelerated AI investments while maintaining cost discipline.

Her 2025 guidance of 5-7% revenue growth and $17.25 earnings per share (a 21% year-over-year increase) signals confidence in their innovation pipeline.

Why I Made the Swap

Both positions made up about 5% of my portfolio, so this was a direct swap.

I believe S&P Global gives me better exposure to financial markets and adds more diversification to my portfolio, which was previously tech-heavy.

I'm not saying Apple is a bad company - far from it.

It's one of the greatest companies ever built. But at a $3.7 trillion market cap with single-digit growth, I think there are better places for my capital.

Let me put Apple's valuation challenge in perspective:

If Apple wants to grow revenue by 10% next year, it would need to add about $40 billion in new sales. That's roughly the size of a Fortune 100 company!

The law of large numbers makes this difficult.

Meanwhile, S&P Global would only need to add about $3.5 billion to achieve the same percentage growth - much more achievable, especially with tailwinds in areas like ESG analytics and debt issuance.

As a young investor, I have time on my side.

I can be patient and let compounding work its magic.

But for compounding to truly be powerful, you need to invest in businesses that can sustain high growth rates for many years.

Apple's growth has slowed (which is natural for a company of its size), but it might not be the best choice for someone with a multi-decade timeline like me.

S&P Global, on the other hand, is positioned in markets with long runways for growth.

The shift to passive investing and the increasing complexity of financial markets are trends that will benefit them for years to come.

Look, selling a popular company like Apple isn't easy.

But here's what I've learned: great products don't always equal great investments.

The best investment opportunities often aren't the household names everyone's talking about.

What matters more than popularity is finding businesses with durable competitive advantages and strong moats that can grow your money over a long time period.

I believe S&P Global fits that description perfectly.

What do you think about this move?

Do you own either of these companies?

Are you bullish or bearish on them?

I'd love to hear your thoughts in the comments!

Great to see your thinking here. Also cool to hear about the buyback program. That’s almost always nice. Good luck with this one.

Nice write up. Trimmed AAPL at start of year as well. SPGI has been at the top of my watch list and with the recent drop I believe I am planning to add.

Just did a write up myself on the company - check it out, would love to hear your thoughts.

https://open.substack.com/pub/manuinvests/p/is-s-and-p-global-undervalued-breaking?r=fhw3n&utm_medium=ios